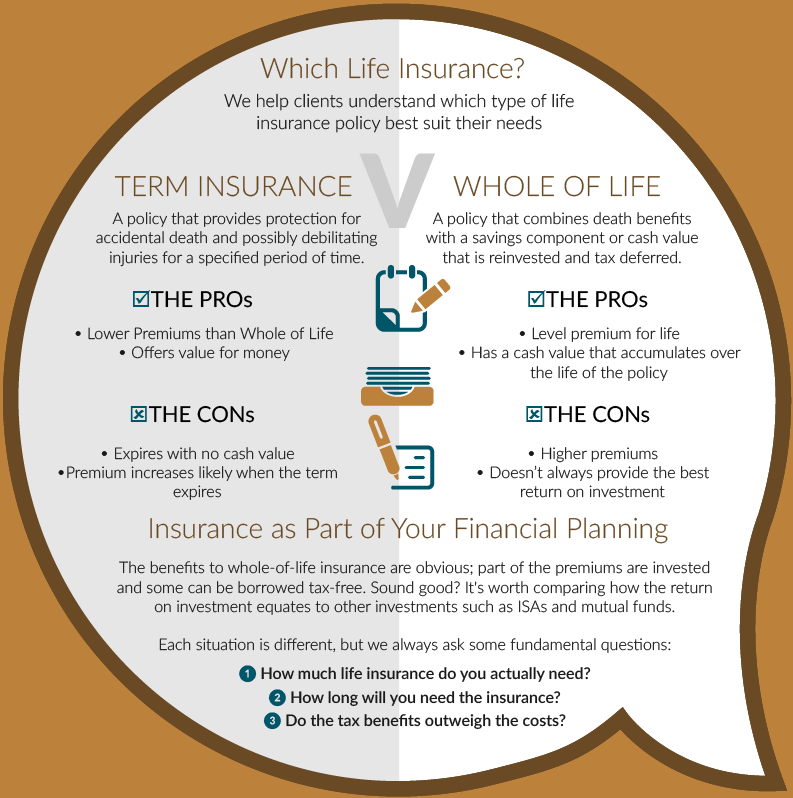

We help clients in sourcing and comparing a broad range of personal and commercial insurances, obtaining the most suitable quotes to meet requirements. Whether you currently have policies that need review or are looking start new cover, we have the experience and insurance industry relationships to guarantee the best possible terms at highly competitive prices.

Many customers now choose to source insurance through comparison sites. Whilst we wouldn’t disclaim this process, it’s well worth noting reasons why this may not be the best approach. Firstly, comparison sites make money via commission and so don’t necessarily offer the best deals. Secondly, you receive no practical advice in the purchase process.